Augusta Precious Metals Review 2023

Last Updated on December 25, 2023

Disclosure: “The owners of this website may be paid to recommend Augusta Precious Metals Goldco, Birch Gold and other companies. The content on this website, including any positive reviews of Goldco,Augusta Precious Metals Goldco Birch Gold or any other company and other reviews, may not be neutral or independent.”

Gold and silver are some of the most liquid wealth preservation and protection forms. If you are looking to improve your finances protect and diversify your savings, it is essential to consider investing in these most valuable precious metals.

Gold and silver have been seen as sufficient assets in times of crisis and have provided safe havens throughout history. They are a dependable asset for long-term investing, and many people are turning to gold IRA companies to start investing promptly. Both hold their value when other investments lose theirs.

By utilizing services from precious metal companies, you can quickly provide the resources you need to buy and store gold in your IRA, providing you with the peace of mind you deserve.

Suppose you’re looking to diversify your portfolio with gold and silver bullion; Augusta Precious Metals can help you make the most of your investment dollars. They have a wide selection of products and an excellent customer service team.

The company can help answer your questions and set you up with an investment plan that matches your investment strategy, enabling you to achieve your financial goals. This review highlights everything you need to know about investing in gold and silver from Augusta Precious Metals.

What Is Augusta Precious Metals?

Augusta Precious Metals is one of the best-rated gold IRA companies that sell gold and silver bullion, coins, and bars. Based in Los Angeles, they are one of the largest online precious metals dealers in the United States.

Augusta Precious Metals is an excellent choice for investors who want extra education or guidance when investing in gold and silver or the gold IRA rollover process. Their sales and customer service teams interact closely with clients and potential investors. This interaction offers clients knowledge about precious metals IRA investing and the benefits of owning physical gold and silver bullion.

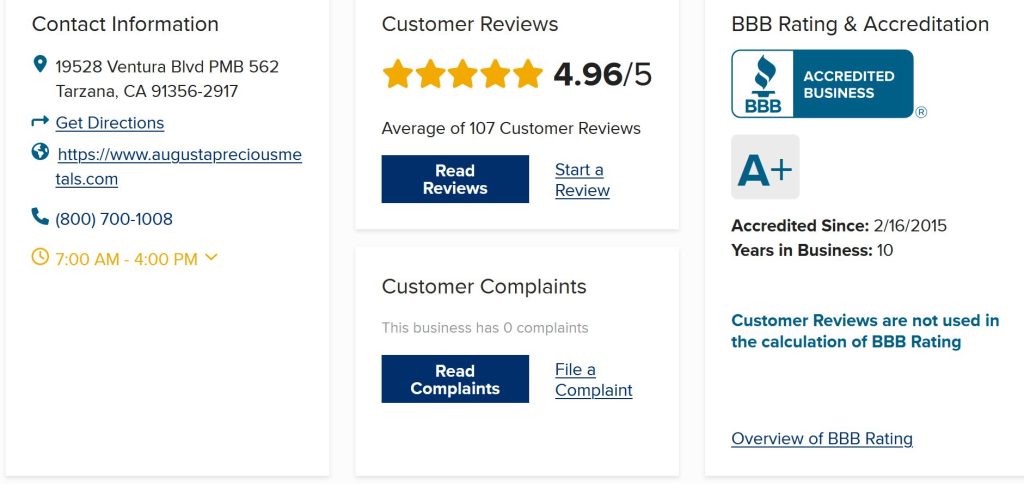

Augusta Precious Metals is the only significant gold IRA company in the United States with no BBB complaints. Augusta’s successful track record with the BBB for over a decade sets the platform apart from most competitors.

Due to no hidden fees or commissions, Augusta can be an excellent option for those looking to own silver and gold either within a retirement account or as their investment at a reasonable and competitive price.

Their customer service reps and order desk staff are committed to answering customer questions. They take time to ensure that customers understand the gold IRA pros and cons and precious metals and the process for ordering them. There are dozens of reviews across verifiable review sites about how excellent the customer service and sales staff are.

Isaac Nuriani, the CEO, founded Augusta Precious Metals in 2012. He started the agency to aid investors in investing in gold and silver in the IRA market for retirement precious metals portfolio diversification. Devlyn Steele is the company’s Director of Education and assists the CEO.

Augusta Precious Metals: Products and Services

Augusta Precious Metals provides investment services for gold and silver and more gold IRA benefits, as outlined below:

Gold & Silver IRA

Augusta Precious Metals allows investors to roll over their existing IRA into a gold or silver IRA. Buying gold and silver in IRA is a great way to diversify your portfolio and protect your retirement savings from inflation. Augusta offers a wide range of gold and silver coins, bars, and rounds to choose from, so you can find the perfect investment for your needs.

Investing in gold and silver IRA assists you in preparing for any potential disasters to come your way. A likely decline in the value of the U.S. dollar and other global economic factors cause stress on your retirement savings leading to a steady reduction in your retirement savings.

Below are gold coin investment options provided by Augusta:

- American Eagle Gold Coin

- American Eagle Proof Coin

- Canadian Maple Leaf Coin

- Gold Canadian Eagle Coin

- American Buffalo Coin

- Australian Striped Marlin Coin

Various silver coins your can purchase from our IRA include:

- Canadian Silver Soaring Eagle Coin

- Canadian Silver Eagle with Nest Coin

- American Silver Eagle Coin

- Canadian Silver Maple Leaf Coin

Gold & Silver Cash Purchases

Augusta Precious Metals offers cash purchases of gold and silver, making it an excellent option for those looking to invest in precious metals outside of an IRA.

When you purchase gold and silver with cash, you get a high level of service from Augusta’s specialized departments and gold and silver professionals. You also get shipping, transit insurance, and secure and private delivery.

401K

A 401k plan is a retirement savings account that allows you to set aside money for the future. Employers offer 401k plans, but you can also set one up yourself. The benefits of a 401k plan include tax breaks and the ability to grow your money over time.

Augusta Precious Metals offers a 401k retirement plan that allows you to invest in gold and silver. The retirement investment plan is a great way to invest in precious metals without paying taxes on the gains. The 401k also offers a great way to diversify your portfolio and protect your assets from inflation.

The Pros and Cons of Investing in Precious Metals

Many people invest in precious metals to diversify their portfolios and protect their wealth. Some investors believe that gold and silver will always have value, regardless of what happens in the stock market. Others invest in precious metals because they think that the value of these metals will increase over time.

The Pros

Here are some of the most common benefits of investing in precious metals.

Who Invests in Precious Metals?

Investors seek physical ownership of gold, silver, platinum, or palladium for reasons outlined below:

Diversification

Gold and silver have a long history of holding their value in uncertain times. The precious metals have even increased in value during economic or political upheaval or when stock markets have plummeted.

An allocation of a portion of your retirement portfolio to gold and other precious metals may be an effective way to hedge your bets and guard against economic crises.

As a result of faulty fiscal policies, deficit spending, and expansionary monetary policy, the economic recovery process has accelerated the dollar’s loss of value, leading to inflation. Diversifying your investment to include the physical purchase of precious metals helps you hedge against the adverse effects of inflation.

Immunity To Inflation

Inflation-adjusted retirement income outside of Social Security could drastically decline without inflation protection. Using physical gold to protect your retirement income can protect you from the insidious cancer of inflation, which tends to damage your wealth.

Owning gold, silver, platinum, or palladium may provide some peace of mind if you expect to live a long retirement and are concerned about inflation. Over time, inflation erodes the value of dollars and decreases your purchasing power, a real threat to your financial security.

Privacy

There is minimal government interference behind investing in precious metals, so funding does not rely on any other country’s currency, and prices do not fluctuate much. You do not have to register your holdings with any third party if you own physical gold and silver bullion. In addition, your physical gold cannot get frozen or seized by an outside institution.

Capital gains on sales must, however, get declared for tax purposes. You also do not have to register gold coins or other bullion under your ownership in anyone else’s records.

There is no way for any trial lawyer to discover this wealth through an internet search. You can only hold physical bullion anonymously as one of the few retirement investments available.

Your IRA custodian will know about the gold and silver you hold within your precious metals IRA. IRAs with gold and silver are also a great way to protect your assets. Traditional and Roth IRAs are more protected against creditor claims than inherited IRAs.

High Liquidity

Another benefit of investing in precious metals is that they are highly liquid. They are easy to buy, sell, trade, and store, which means small investors get good liquidity at reasonable prices. Liquidity means you can easily buy and sell them without worrying about finding a buyer or selling at a loss.

For example, if you have 1000 ounces of gold and want to change it into silver, there will be no problem converting it. In contrast, if you had 1000 shares of stock worth $1000 and tried to convert it into another type of asset, there may not be enough buyers for your supplies. The sale would have to happen at a lower price than it’s worth to achieve liquidity.

Universal Use

Currency rates are constantly changing between countries. Investing in silver and gold means buying something that has value everywhere, regardless of the economy. Objects with inherent value are unquestionably the most universally accepted form of currency.

The Cons

In recent years many people have looked to invest in gold and silver, making precious metals an attractive investment option. However, there are some risks associated with investing in precious metals.

Here are some gold IRA cons to consider before investing:

- The market can be volatile and cause unexpected losses or gains in a short period.

- Uncertainty around future interest rates.

- It is difficult to predict how inflation will affect the value of your assets over time.

What Differentiates Augusta From the Competitors?

Being one of the best-rated IRA companies, Augusta Precious Metals is a cut above the rest due to competitive pricing, personalized education, and more.

Detailed Guides and a Personalized Education

The agency’s new clients get educated through a personalized web conference about investing in physical gold and silver for their specific needs. The web conference gives customers direct support and a clear understanding of the asset class, details of the shipping process, and more. Moreover Augusta has an on-staff Harvard-trained economist-Devlin Steele. He teaches savers what’s going on in our economy.

Competitive Pricing

Augusta Precious Metals requires a $50,000 minimum investment. Augusta Precious Metals usually is very cost-efficient for investors who can afford the minimum investment. The $50,000 investment charge is not the lowest on the market, but this price is competitive for most investors.

No Hidden Fees

More often than not, the customer has to pay a fee to the IRA custodian and the depository company. Gold IRA customers should be relatively pain-free if the company does not add to the burden.

If you purchase a bullion bar for your account from Augusta, you will pay no additional fees and surcharges over the cost of the metal and taxes as long as you avoid third parties.

An Easy, Straightforward Process

Every Augusta customer is assigned an account rep who usually sticks around with them and provides lifelong customer support. What this allows is a smoother and less time-consuming investment process.

Lifelong customer support makes IRA processing convenient because customers do not encounter multiple account representatives when making rollover or distribution transactions.

Excellent BBB Reviews

Augusta Precious Metals is one of the most reputable gold and silver dealers in the United States. They have an A+ rating with the Better Business Bureau (BBB), which is the highest rating that a company can have. Augusta Precious Metals BBB data also indicates that there have been zero complaints about the company throughout its ten-year history.

Joe Montana – Augusta Spokesperson

Montana’s main priority after retiring from football was to maintain a high quality of life and ensure that the future generations of his family would be financially secure. The Hall of Fame Quarterback always believed in a diversified approach to growing his savings and trusted his financial team to guide his decision-making.

He pursued purchasing gold and silver as an intelligent way to diversify assets and his portfolio. Still, he could not find a reliable precious metals company that he felt comfortable buying gold and silver for a while.

As Montana became more interested in investing in precious metals, he asked his team of financial advisors to suggest the best precious metals company for him. Their recommendations led to Montana screening and interviewing Augusta Precious Metals anonymously and personally.

He then became a repeat customer after speaking with Devlyn Steele, which made him learn the outstanding services offered by Augusta Precious Metals. He met a knowledgeable team of experts and experienced a smooth flow of ongoing IRA transactions.

Joe Montana encourages people to attend the Augusta Gold and Silver Web Conference that enriches you with knowledge on gold and silver investment options for a self-directed IRA. Montana offered his services as a celebrity spokesperson after discovering what he had sought for a long time.

What Do You Need To Be Eligible To Invest in Precious Metals With Augusta?

You need at least $50,000 to set up an IRA account with Augusta Precision Metals. You also need a $50 one-time fee. Augusta Precious Metals also require you to pay a $125 administration fee for balances up to $100,000 and a $75 fee for balances more than $100,000 per year.

By owning physical bullion in a self-directed IRA account, you will enjoy the same benefits as any other traditional IRA. Generally, gold IRA investments are tax-deferred. The investments are only taxed at ordinary income rates when the money gets withdrawn.

Setting Up a Gold or Silver IRA Account

As a retirement investor, you may own various types of assets within an IRA. However, you cannot invest IRA money in the life insurance or collectibles, and you cannot hold physical gold or silver bullion within your IRA.

IRAs and solo 401Ks are tax-advantaged retirement accounts that can hold gold coins or other precious metals on behalf of their owners. It would be best if you had an IRS-approved custodian to keep these assets on your behalf.

Some custodians do not hold precious metals in retirement accounts. Firms of this type can only keep paper assets, holdings, notes, mutual fund investments, exchange-traded funds, money market funds, and inheritances.

Most traditional, broker-dealer-type companies generate the bulk of their revenues from securities trades and the resulting commissions or collecting assets for investment management and advisory fees. They do not make any money off the sale of gold and silver coins, so they want to guide you about owning physical gold and silver.

They fail to mention how easy it is to buy and store physical gold under your name or through your retirement account. Traditional companies will not let you through the transaction when you get to know about owning precious metals physically. You will need to take your money out of their account and establish a new tab with a gold IRA provider like Augusta Precious Metals.

How Will Your Gold&Silver Be Stored?

Augusta is working closely with Delaware Depository. Your precious metals will be stored in a highly secure non-government depository storage facility. Also worth noting facts :

- $1 billion all-risk insurance through London underwriters.

- Exchange-approved depository for CME & ICE.

- IRS compliant (IRC – 408n) depository for IRA assets.

- Bullion fully allocated and held off balance sheet.

Augusta Fees and Buy-Back Policy

Augusta Precious Metals gains profit by acquiring gold and silver at wholesale prices and selling them at retail prices. As mentioned, the platform has no hidden charges on top of the cost of the precious metals and tax, provided you avoid third parties.

Fees

Expect a one-time fee of $50 if you set up your Augusta Precious Metals IRA account using Equity Trust as your custodian. The custodian will charge you an additional $80 per year. You will also pay $100 annually to the company that handles the storage of your physical gold.

You will not need to pay any storage or custodial fees if you purchase gold and silver coins under your name instead of in the name of a retirement account. You must open an account with a minimum purchase of $50,000 in the form of IRA purchases, cash purchases, or both.

Buy-Back Policy

Bullion investors need highly liquid precious metals such that they can turn their bullion holdings into cash if required. Augusta Precious Metals is best for providing a secondary market for gold and silver bullion.

Augusta pays you the current price of precious metals for buybacks, depositing cash to your bank account or IRA swiftly. Their competitive pricing on gold and silver buybacks makes them a preferred option for many investors.

Shipping and Transit Policies

All orders’ shipping and transit insurance are free at Augusta Precious Metals. Augusta’s shipping is also safe and private. When you receive precious metals from Augusta Precious

Metals, the box will not indicate the value or nature of the contents, so you and your home’s security are not compromised.

Augusta Precious Metals Reviews & Testimonials

Augusta continues receiving outstanding customer reviews on all significant industry-standard review sites and is one of the best-rated gold IRA companies on the market. Here are Augusta Precious Metals reviews in 2022 and ratings from consumer website ratings.

BBB

The Better Business Bureau has been protecting people for a century by working to guarantee business reliability. In addition, they are here to facilitate the opinion of customers for the services provided.

Better Business Bureau (BBB) ranks Augusta with a rating of 4.96 out of five based on 107 reviews, considerably higher than most of their competitors.

Mitzi B, a reviewer on the BBB platform, says, “Augusta Precious Metals is extremely helpful as you navigate the metal IRA industry. I appreciate their patience with all of my questions and concerns. Easy to work with, and deliver in good timing.”

TrustLink

Based on 283 customer reviews, Augusta has a 5-star rating with TrustLink. Moreover, Augusta has topped the Best old IRA Company rankings in the gold IRA company category for several years.

Michelle D gave Augusta Precious Metals a five-star rating and said, “Very pleased with my initial contact with this company. They are very helpful and informative.”

Google My Business

Google’s review site is one of the most popular and easy to access on internet devices. Google My Business rates Augusta at 4.9 stars, a considerably high rating in the precious metals ira category, based on 258 reviews.

Michael Gutfeldt expressed his pleasant experience with the company by giving them a 5-star rating. He left a positive note saying, “Augusta Precious Metals representatives spent an hour on Zoom with us, presenting information about investing in precious metals and answering our many questions. They patiently explained how the process works and what are our options. They were highly professional and never pushy.”

Augusta Alternatives

Augusta Precious Metals has grown to become one of the most respected and well-known precious metals dealers, but that doesn’t mean they’re the only one in town. If you’re looking for an alternative to Augusta Precious Metals, here are some companies that offer similar products and services.

Goldco

With more than a decade of experience in the precious metals industry, Goldco can help protect your IRA, 401K, 403B, TSP, savings, or similar tax-advantaged retirement account. The platform has knowledgeable specialists that help you create your IRA account.

Furthermore, Goldco can directly sell you gold and silver, helping you diversify your money using these precious metals. Whether you want to roll retirement assets into a precious metals IRA or buy gold and silver directly, a Goldco expert can help you find suitable investments. The specialists also help you go through the investment process from start to end.

With Goldco, you will have the security of the highest buyback price if your circumstances change. You can choose from a vast selection of precious metals, and the platform offers prices at the highest comfort and security levels.

With an A+ rating by the Better Business Bureau and a Triple-A rating by the Business Consumer Alliance, Goldco’s high-quality customer service, dependability, and honest practices have been recognized by many satisfied customers and great reviews.

Birch Gold

Birch Gold Group is an excellent gold IRA company supported by its customers, the industry, and significant media providers. As a customer, you will have an opportunity to express all of your objectives, motivations, and concerns. Birch Gold Group is here to empower its clients.

At Birch Gold, you have the opportunity to ask any question about gold and silver or any question related to our company, and the company will provide an open line of communication with you.

Once you understand all the different types of investments, Birch Gold can recommend what best suits your right and wrong needs. You can feel confident in your decisions when educated on this.

The organization was founded in 2003 and has grown since to become one of the largest distributors of precious metals in the United States, including gold, silver, platinum, and palladium. Birch Gold gets featured on various major news and media outlets, including the Ben Shapiro Show, where it discussed market instability and cyclical patterns.

Combined with our customer care process, the experience of Birch Gold’s team of professionals will make your purchase or IRA setup seamless and straightforward. Any questions you may have about planning for retirement will be answered by our team quickly so that you can make an informed decision for yourself. The Customer Relations Department follows up with each customer to ensure the highest levels of customer satisfaction.

The Birch Gold Group is recognized for its exemplary record within the industry, as evidenced by the numerous accolades earned by the company and the high ratings from independent review organizations.

The Birch Gold has an A+ rating over at the Better Business Bureau and a AAA rating with the Business Consumer Alliance.

American Bullion

American Bullion, Inc. has been in the business for more than ten years. Having helped members of the speculation community as commodity brokers, the leaders at American Bullion, saw that there was a desire for an investment option in the face of almost anything that comes.

In many years of trading, gold and other precious metals have had more than enough success. Considering there were many investors with various IRA’s, they opted to educate and facilitate investors who want to make the process of transferring or rolling over their IRA and/org another qualified account into their desired gold IRA, which had been permitted for a dozen years but was underutilized.

As a result, Orkan Ozkan and Nevtan Akcora put the dream of a gold IRA within everyone’s reach, unlike before, when the process of implementing a gold IRA was risky and costly.

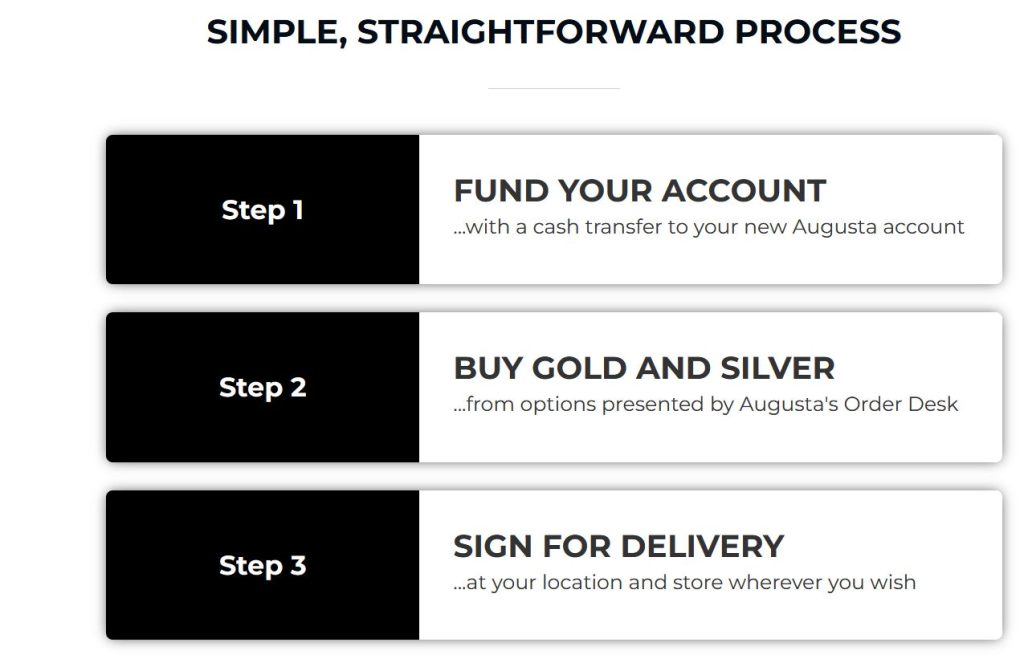

How To Get Started With Augusta Precious Metals

With Augusta Precious Metals, you can transfer old retirement savings to a new account. Alternatively, you may choose to perform an IRA rollover from an existing eligible retirement account. The easiest way to get started is clicking here and an Augusta specialist will help you start the process. It will include the following steps (might be different depending if you have an IRA or 401k).

Open an account

First, you need to pick a custodian for your IRA that allows you to self-direct your retirement account. In this case, select Augusta Precious Metals. The company works with Equity Trust, a well-respected, established, and profitable company and leader in the self-directed IRA industry.

Fund the Account

You can do a direct rollover if you already have a retirement account and the existing one, for example, an IRA. You can file a form directing your previous retirement account custodian to wire the funds to your new IRA account.

Instead, you could request that your old company send you a check or wire money to your account. Within two months, you can transfer the funds into your new IRA. The IRS will assess taxes and penalties after the period if the IRS believes the transfer to be a distribution.

Furthermore, your former employer will withhold 20% of the amount you withdraw and send it to the IRS as tax. Your new account will still require you to deposit 100 percent of your withdrawal amount. Due to this, most people prefer direct trustee-to-trustee transfers.

401K plans don’t transfer funds if you still work for the company. In-service withdrawals from 401Ks are not allowed.

Buy Your Precious Metals

Purchasing gold and silver for your IRA account is very straightforward. Augusta does not offer precious metals certificates for sale. You buy physical gold or silver coins or bars. It is vital to the organization that the process is simple, transparent, and streamlined so that you can select the precious metals and other assets you want to own.

Wrapping Up-Augusta Precious Metals Review

As one of the world’s most recognized precious metals companies, Augusta specializes in helping individuals get started with low-cost, high-quality bullion bars and coins. With decades of experience, Augusta’s executives have developed the expertise necessary to help investors like you grow their wealth through gold and silver investments.

If you’re interested in investing in gold and silver in 2022, consider Augusta Precious Metals.

FAQ

Some of the benefits of buying gold and silver within an IRA include:

Investment diversification: Gold and silver can help to reduce the overall volatility of an investment portfolio, since their prices are not closely correlated with stocks or other traditional investments.

Potential for long-term growth: Gold and silver have historically shown a higher rate of return than many other types of investments.

Protection from inflation: The value of gold and silver tends to increase as inflation rises, which can help to protect the purchasing power of your savings.

Additionally, when you buy gold and silver within an IRA, it is held in a secure location on behalf of the account holder, so you don’t have to worry about storing it yourself.

Augusta Precious Metals does have good reviews. People like the fact that they are a family-owned and operated business, and they offer competitive prices on gold and silver products. They also offer a buyback guarantee, which gives people peace of mind when buying products from them.

You can check out Augusta’s excellent ratings on the Better Business Bureau,TrustLink, Google My Business and the company’s website. which is another indication that they are a reputable company. Overall, Augusta Precious Metals has a lot of good reviews from customers, and they seem to be a company that people can trust.

Yes, Augusta does have an affiliate program which pays $200 for a qualified lead and 10% of the deposit the customer makes , which makes it one of the most lucrative affiliate programs out there. You can read more about Augusta affiliate program review here